Author: @BlazingKevin_, the Researcher at Movemaker

Latin America is undergoing a financial infrastructure revolution forced by currency failure. This article provides a panoramic analysis of the region's stablecoin market based on macroeconomic data from 2024 to 2025, on-chain behavior analysis, and regulatory policy texts. The research finds that the Latin American market has moved beyond the early stage of passive dollarization and is undergoing a deep transformation towards Web3 financial infrastructure-ization.

At the macro level, Argentina's 178% inflation rate and Brazil's $300 billion crypto trading volume form the dual backdrop of stablecoins as both a survival tool and an efficiency tool. At the micro level, the market is breeding a new species—Crypto Neobank. Compared to traditional fintech giants like Nubank, Crypto Neobanks, utilizing zero-fee networks like Tether-supported Plasma and DeFi yields, are filling the vast vacuum between traditional banking and pure crypto speculation. This report points out that the next alpha opportunity in Latin America's crypto market lies in how Web3 infrastructure can leverage this $1.5 trillion trading volume to replicate and surpass the growth miracle of traditional fintech.

1. Macro Narrative Restructuring

To understand the uniqueness of the Latin American market, one must abandon the "technological innovation theory" perspective of North America or Europe. In Latin America, the explosion of stablecoins is an inevitable product of macroeconomic structural imbalances. The core drivers here are survival and efficiency, and the intervention of Web3 technology is transforming this passive survival need into an active financial upgrade.

1.1 Currency Failure and the Loss of Store of Value Function

Inflation is the strongest catalyst for the crypto-dollarization process in Latin America. Argentina and Venezuela are typical examples of this phenomenon.

Despite the Milei government's radical economic therapy, Argentina's annual inflation rate remained as high as 178% between 2024 and 2025, with the peso depreciating by 51.6% against the US dollar within 12 months. In this environment, stablecoins are no longer investment products but de facto units of account. On-chain data shows that stablecoins account for up to 61.8% of trading volume in Argentina, far exceeding the global average. The market's demand for stablecoins exhibits extremely high immediate price elasticity: whenever the exchange rate falls below key psychological barriers, monthly stablecoin purchases on exchanges surge to over $10 million.

In Venezuela, as the bolivar's value continues to evaporate, Tether has penetrated microeconomic activities such as supermarket shopping and real estate transactions. Data shows a strong negative correlation between the local fiat exchange rate and cryptocurrency reception volume, with stablecoins providing a parallel financial system immune to government monetary policy interference.

1.2 Banking Exclusion and the Financial Vacuum of 122 Million People

Besides fighting inflation, financial exclusion is another major pain point. In Latin America, 122 million adults (26% of the population) are unbanked. This massive group is excluded from the traditional banking system due to minimum balance requirements, cumbersome compliance documents, and geographical isolation.

This is precisely the soil for the rise of new banks. Nubank's success proves this logic: through a branchless, low-fee mobile banking model, Nubank captured 122 million users within a decade, reaching a market capitalization of $70 billion and covering 60% of Brazil's adult population.

However, Crypto Neobanks are upgrading this logic for a second time. While Nubank solved the accessibility problem, the accounts are still denominated primarily in local fiat, and savings yields often underperform inflation. In contrast, Web3 neobanks can provide USD stablecoin-based accounts without needing a banking license, and through DeFi protocol integration, can offer 8% to 10% USD-denominated annualized yields, which is致命ly attractive to users in inflationary economies.

1.3 The Cost-Reduction and Efficiency Revolution in the Remittance Economy

Latin America is one of the world's largest remittance reception regions, receiving over $160 billion in remittances annually. Traditional cross-border remittances typically charge 5% to 6% in fees and take days to settle. This means nearly $10 billion in wealth is lost annually in the form of fees.

In the US-Mexico corridor, the world's largest single remittance channel, Bitso has processed over $6.5 billion in remittances, accounting for 10%. Blockchain-based cross-border transfers can reduce costs to $1 or even a few cents, shortening settlement time from 3-5 days to seconds. This hundredfold efficiency improvement constitutes a dimensional打击 against the traditional financial system.

2. Market Depth and On-Chain Behavior

Data from 2024 to 2025 indicates that the Latin American region has developed a unique Latin American model for cryptocurrency adoption: high-frequency, large-volume, and highly institutionalized.

2.1 Trading Volume and Growth Resilience

According to comprehensive data, between July 2022 and June 2025, the Latin American region recorded nearly $1.5 trillion in cryptocurrency trading volume, with a year-on-year growth of 42.5%. Notably, even during global market volatility, Latin America's growth baseline remained solid. In December 2024, the region's monthly trading volume soared to a record $87.7 billion. This indicates that the growth of the Latin American market is not merely beta收益 following the global bull market cycle but has an endogenous logic of rigid demand.

2.2 Brazil's Institutional Hegemony and Argentina's Retail Frenzy

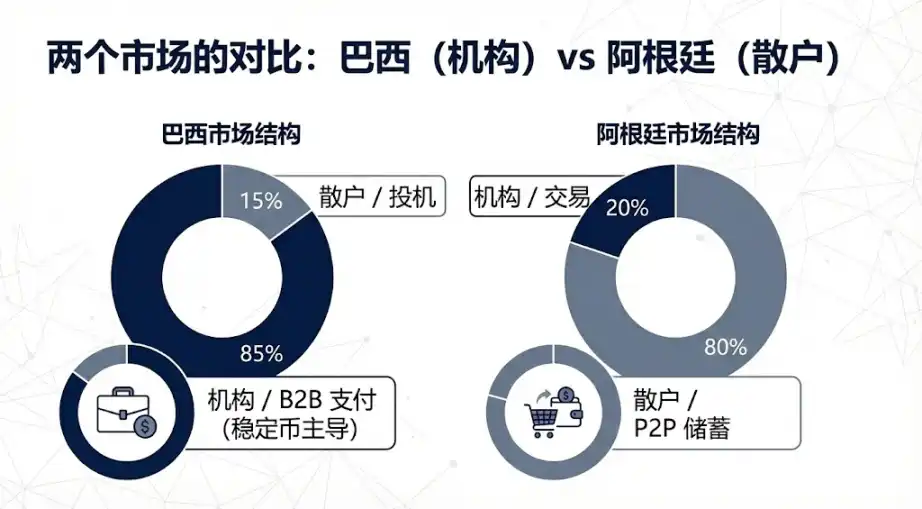

Market structures vary significantly by country:

Brazil is the undisputed leader in the region, receiving approximately $318.8 billion in crypto assets, nearly one-third of the regional total. Stunning data from the Brazilian Central Bank shows that about 90% of the country's cryptocurrency fund flows are conducted through stablecoins. This extremely high比例 reveals the high degree of institutionalization in Brazil—stablecoins are primarily used for inter-enterprise payments, cross-border settlements, and liquidity transfers, rather than retail speculation.

Argentina ranks second with a trading volume of approximately $91.1 to $93.9 billion. Unlike Brazil, Argentina's growth comes mainly from the retail end, reflecting the general public's adoption of crypto dollarization as a daily lifestyle to combat inflation.

2.3 Platform Preference: The Dominance of Centralized Exchanges

Latin American users heavily rely on centralized exchanges. Data shows that about 68.7% of trading activity occurs on centralized exchanges, the second-highest proportion globally.

This phenomenon has important strategic significance for Web3 projects entering Latin America. "Borrowing a ship to go to sea" is the best strategy. Since local exchanges like Mercado Bitcoin and Bitso have compliant fiat channels and deep user trust, Crypto Neobanks should not try to directly compete with their fiat on-ramp/off-ramp business but should penetrate their vast user base through cooperation.

3. Asset Evolution

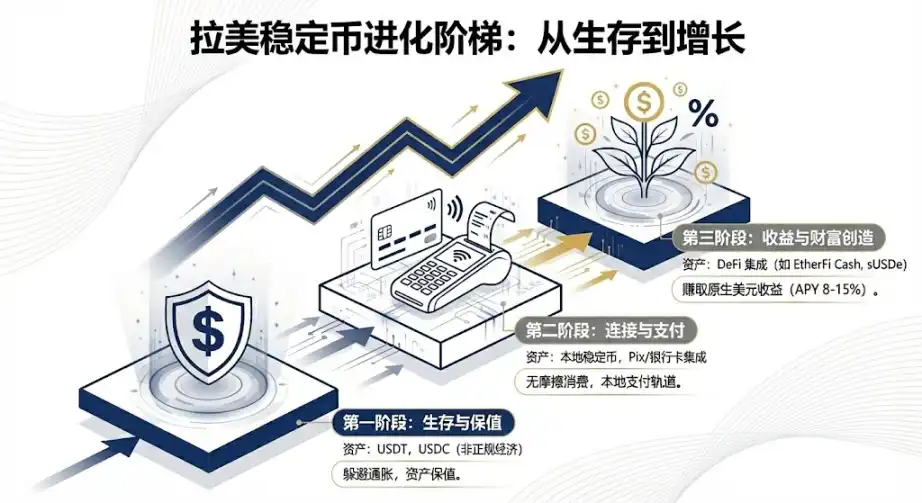

The Latin American market presents a landscape where globally universal stablecoins coexist with local innovative assets and is undergoing a generational leap from holding for保值 to holding for增值.

3.1 The Duopoly of Tether and USDC

With first-mover advantage and deep liquidity, Tether remains the hard currency in Latin American peer-to-peer markets and the informal economy. In the over-the-counter markets of Venezuela and Argentina, Tether is the absolute unit of account. Brazilian tax data also shows that Tether accounts for about two-thirds of declared trading volume. Its censorship resistance and普及度 make it the preferred choice for circumventing capital controls.

USDC is making inroads through compliance. Circle's partnerships with giants like Mercado Pago and Bitso have made it the preferred choice for institutional settlements. Bitso's report指出 that by the end of 2024, USDC had become the most purchased asset on its platform, accounting for 24%, surpassing Bitcoin.

3.2 The Bridging Role of Local Fiat Stablecoins

In 2024-2025, stablecoins pegged to local Latin American fiat currencies began to emerge, aiming to solve the friction between local payment systems and blockchain.

The launch of Meli Dólar by e-commerce giant Mercado Libre in Brazil was a milestone event. Through Mercado Pago, it is embedded in the daily shopping of tens of millions of users, used as a credit card cashback vehicle, significantly lowering the user barrier. Furthermore, Num Finance's issuance of peso and real-pegged stablecoins primarily serves cross-exchange arbitrage and enterprise-level DeFi operations, helping local businesses manage liquidity on-chain without bearing exchange rate risk.

3.3 Trend Mutation: Yield-Bearing Assets and DeFi Integration

This is the next alpha opportunity in the Latin American market. Traditional banks in Latin America typically offer very low interest rates on USD accounts. Web3 neobanks, by integrating DeFi protocols, are redefining savings.

Take EtherFi as an example. As a DeFi protocol, it leveraged its multi-billion dollar Total Value Locked (TVL) to launch a credit card product. Users can stake crypto assets to earn yield while spending with the card. This model allows users to consume through borrowing without selling assets, preserving upside exposure while solving liquidity issues.

In high-inflation countries, the native yield of 10% to 15% offered by synthetic dollar stablecoins like USDe is highly attractive. Compared to the real-denominated deposits offered by Nubank, a 10% USD-denominated annualized yield is a dimensional打击 against traditional savings products.

4. Divergent National Directions

The vastly different political and economic environments across Latin American countries lead to截然不同的 development paths for stablecoins.

4.1 Brazil: A Duet of Compliance and Innovation

Brazil is Latin America's most mature and compliant market. The Brazilian Central Bank's digital currency project, Drex, underwent a strategic shift in 2025, focusing instead on the wholesale端, leaving a huge retail market space for private stablecoins.

In the same year, Brazil implemented a unified crypto tax rate and clarified the foreign exchange regulatory status of stablecoins. While this increased costs, it also赋予 the industry legitimacy. The local innovation project Neobankless is a paradigm of this trend. Built on Solana, its front end completely abstracts blockchain complexity, directly integrating with Brazil's national payment system PIX. Users deposit reais, which are automatically converted into interest-bearing USDC in the backend. This "Web2 experience, Web3 backend" model directly challenges the user habits of traditional fintech.

4.2 Argentina: A Liberalization Testing Ground

The Virtual Asset Service Provider (VASP) registration system established by the Milei government, while adding compliance thresholds,实质上默许了 the monetary competitive status of USD stablecoins. The asset regularization plan further brought a large amount of gray market stablecoins to the surface.

Lemon Cash solved the "last mile" payment problem by issuing crypto debit cards. Users hold USDC to earn yield, converting to pesos only at the moment of swiping the card. This model is highly sticky in a high-inflation environment because it minimizes the time holding fiat currency.

4.3 Mexico and Venezuela: Polarization

Due to the "Fintech Law" and central bank restrictions, Mexico has formed a landscape where banks and crypto companies are segregated. Companies like Bitso have therefore vigorously developed business-to-business (B2B) operations, using stablecoins as an intermediate bridge to optimize US-Mexico cross-border fund transfers, bypassing the inefficiencies of the traditional banking system.

In Venezuela, against the backdrop of reinstated sanctions, Tether has even become a settlement tool for oil exports. Among the populace, Binance's peer-to-peer trading remains a lifeline for obtaining foreign exchange, with the market彻底 voting with its feet for private USD stablecoins over the failed official Petro coin.

5. From Traditional Finance to Crypto Neobank

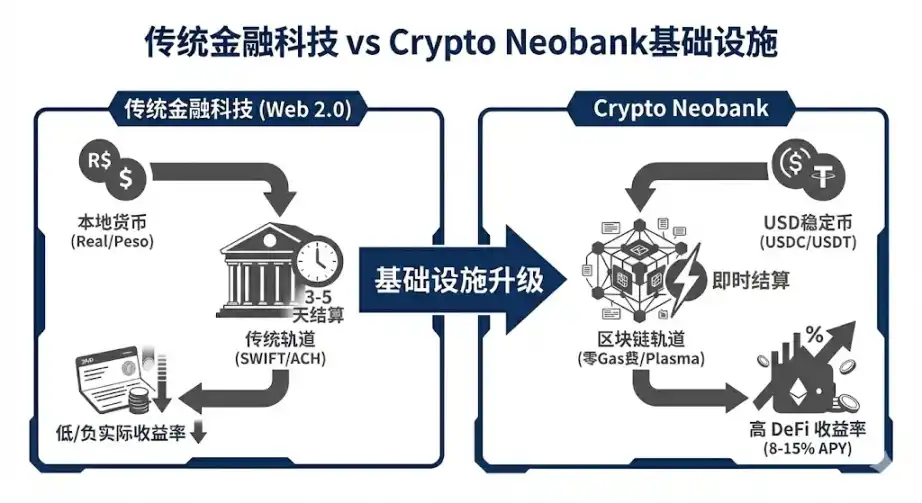

The Latin American market is undergoing a critical turning point, evolving from traditional fintech to Crypto Neobank. This is not only a technological upgrade but also a generational leap in business models.

5.1 The Valuation Gap and Alpha Opportunity

Currently, Nubank has a market cap of approximately $70 billion, and Revolut is valued at $75 billion; they validate the commercial viability of digital banks in Latin America. In contrast, the entire Web3 neobank赛道 has a combined valuation of less than $5 billion, only 7% of Nubank's market cap.

This is a huge value洼地. If Crypto Neobanks can capture even 10% of Nubank's market share, utilizing a superior unit economics model, their valuation has the potential for a 10x to 30x increase.

5.2 Next-Generation Infrastructure: The Zero-Fee Revolution

One of the biggest obstacles to the widespread adoption of crypto payments is gas fees. Plasma and its flagship product Plasma One brought a breakthrough. As a blockchain officially supported by Tether, Plasma enables zero gas fees for Tether transfers. This removes the biggest psychological and economic barrier for users using cryptocurrency for payments.

The data showing Total Value Locked (TVL)突破 $5 billion within 20 days of launch proves that when infrastructure directly provides bank-level services, the inflow of funds is惊人. This vertically integrated model of "infrastructure + neobank" could become the mainstream in the future.

5.3 Dimensional打击 of the Business Model

Crypto Neobanks have a triple moat compared to traditional banks:

- Settlement Speed: Reduced from 3-5 days with SWIFT to seconds on the blockchain.

- Account Currency: Upgraded from depreciating local fiat to anti-inflation USD stablecoins.

- Revenue Source: Shifted from earning存贷利差 to allowing users to share the native yield of DeFi protocols.

For Latin American users, this is not just a better experience but a rigid demand for asset保值.

6. Challenges, Strategies, and Endgame Predictions

6.1 Challenges and Breakout Strategies

Despite the bright prospects, events where banks关闭 crypto company accounts out of compliance fears still occur occasionally in Mexico and Colombia. Furthermore, Latin American regulation is highly fragmented, resulting in extremely high compliance costs for跨国 operations.

Targeting the Latin American market, Web3 projects need to follow a specific winner's playbook:

Brazil First: Given that Brazil accounts for 31% of Latin American crypto trading volume and has a完善的 payment system, it must be the primary battlefield.

Niche First: Don't try to be a bank for everyone from the start. The successful path is to first capture a细分 community and then扩散.

Viral Marketing: 90% of Nubank's growth came from word of mouth. Crypto Neobanks should leverage on-chain incentives to achieve low-cost裂变 in social networks like WhatsApp.

6.2 Market Predictions

Based on the above analysis, we make the following predictions for the short-to-medium term development of stablecoins:

Private Stablecoins Replacing CBDCs: Given the retreat of Brazil's Drex on the retail端, privately issued compliant stablecoins will de facto assume the role of digital fiat currency.

Mainstreaming of Yield-Bearing Assets: Stablecoins that do not generate interest may face competition from yield-bearing assets like tokenized US Treasuries. Latin American users will increasingly prefer to hold assets that are both anti-inflationary and yield-generating.

Market Stratification: The market will bifurcate into two camps: one highly compliant, bank-integrated whitelisted market, and another gradually shrinking but still existing gray peer-to-peer market.

Conclusion

Latin America's stablecoin market is the world's most cutting-edge laboratory for fintech. Here, stablecoins are not a nice-to-have technology but a must-have necessity. From the digital lifebuoy in the hands of Argentinians to the cross-border settlement tool in the hands of Brazilian financial giants, stablecoins are reshaping the financial arteries of this continent.

With the landing of regulatory frameworks in 2025 and the rise of the new species Crypto Neobank, Latin America is expected to become the first region in the world to achieve large-scale commercial adoption of stablecoins. For investors, the current window of opportunity is only 12 to 18 months. Whoever can leverage Web3 rails to replicate Nubank's user experience before 2026 will become the next hundred-billion-dollar giant. The race has already begun, and Latin America is the untapped gold mine.